Worldpay: Bridging the Gap Between Payment Convenience and Customer Expectations in Mobility

Shifting Gears - Tracking trends in mobility and ground transport payments

The world of mobility and ground transportation is constantly evolving, and new technology is driving much of that change – particularly when it comes to payment.

Worldpay carried out a survey in 2023 to discover what’s working and what’s not. We talked to thousands of consumers about their payment experience across a wide range of publicly available transport, from trains and taxis to scooters and ebikes. Our findings have identified clear payment preferences along with some gaps in customer expectations; areas that operators can address to boost sales, increase loyalty, and drive growth.

Five main themes emerged from our research into today’s travel payment landscape:

- Contactless payment is king.

- Older generations are embracing new payment technologies.

- Convenience is the #1 driver of choice.

- Brand loyalty is hard to find.

- Consumers want seamless payment across transport types.

In July 2023, we conducted a study to analyze the payment preferences of consumers across these forms of urban mobility:

- Public transport (ticketing platform, bus, train, tram etc.)

- Publicly available Electric Vehicle Charging

- Smart Parking Taxi, ride-hail (Uber, Bolt etc. for private use), rideshare (for Uber, Lyft etc. shared use)

- Publicly available micromobility (scooters, e-bikes etc.)

Who we spoke to:

We surveyed over 2000 regular and recent consumers, aged 18-86, in both urban and suburban areas of the United Kingdom and the United States.

In this article, we’re going to present you with the results on publicly available EVC and paid parking.

Publicly Available EVC

The electric vehicle (EV) market is expanding rapidly in terms of both car sales and charging infrastructure, and there are big opportunities for suppliers who improve the currently inconsistent charging payment experience.

With EV sales expected to reach 20% of global car sales by 2025 and 59% by 2035, there is a corresponding surge in demand for public electric vehicle charging (EVC) – the global market is projected to hit $222bn by 2032.

Despite the scale of this opportunity, inconsistent payment experiences are hindering EV adoption and public charging. EVC suppliers who prioritize meeting customer expectations in payment methods stand to drive growth in the market and gain a significant market share.

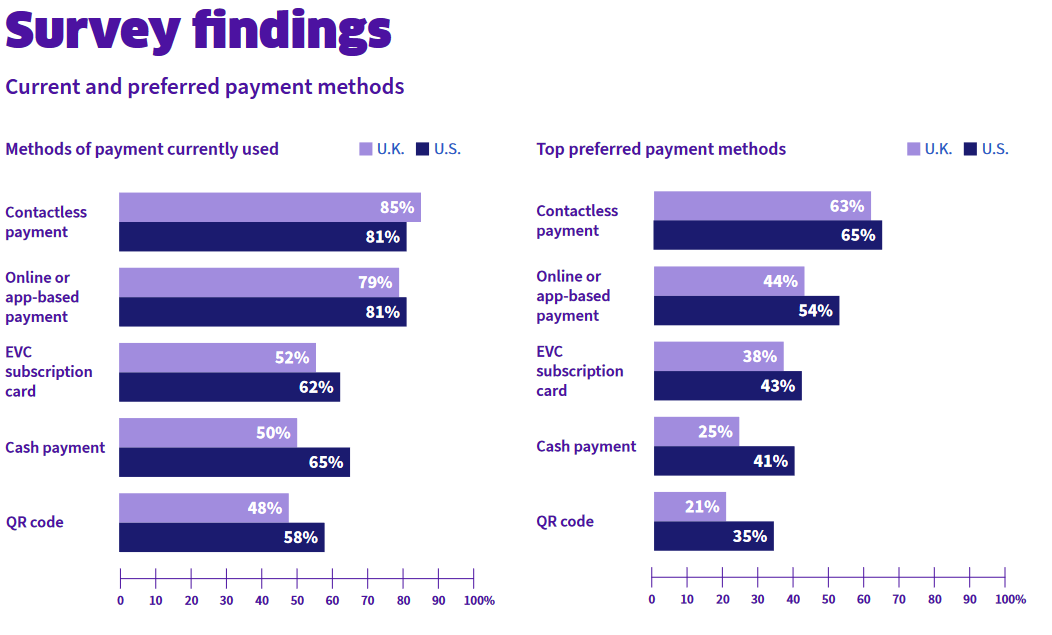

The results indicate that users of electric vehicle charging in the U.K. and U.S. tend to use multiple payment methods, with contactless and online/ app‑based payments are the most popular methods across both regions, followed by subscription cards.

EVC subscriptions were one of the first methods of payment available for public chargers and are still preferred over cash and QR codes in both regions. While they are still used by 59% of people in the U.S. and 48% of people in the U.K., QR codes are the least used and least preferred form of payment for EVC across both regions.

Convenience is the most important factor for users when choosing a payment method, and the ability to avoid carrying cash is also a significant consideration. These findings bolster the notion that businesses offering EVC services should prioritize contactless and online payment methods to provide the best experience for their customers.

The Key Take-Outs

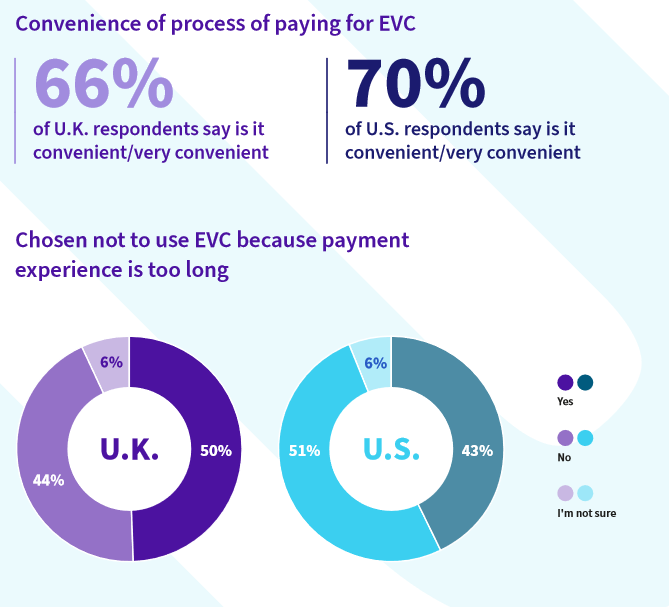

Lengthy Payment Processes are Slowing Down Growth

|

The convenience of the payment process for public electric vehicle charging is generally satisfactory with 70% of U.S. and 66% of U.K. users finding it convenient, but there is room for improvement. |

|

The Case for EVC Subscription Services

|

|

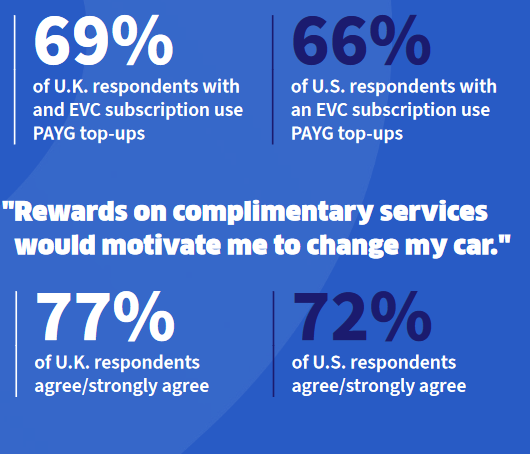

The research indicates that there is high demand for subscription services, with 73% of U.S. and 69% of U.K. users likely to subscribe. |

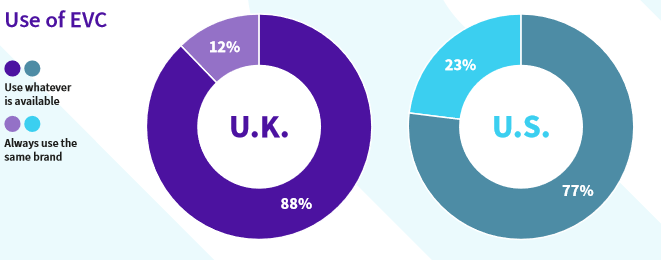

A Lack of Brand Loyalty

| Our research highlights a clear lack of brand loyalty among EVC charging users in both the U.S. and the U.K., with most drivers (except Tesla) using whatever brand is available to them. |

|

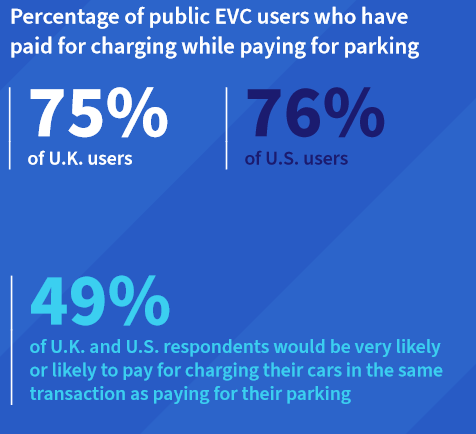

Creating Synergies

|

|

Implementing a loyalty reward scheme can effectively address the brand loyalty crisis in the Electric Vehicle Charging (EVC) industry. |

Paid Parking

In recent years, digitalization and the global push towards sustainability have prompted the rise of online and mobile smart parking systems, transforming the way people pay for the service.

With higher customer expectations for easy, seamless, and secure payments growing, it’s vital that parking companies not only adopt these new technologies, but also harness the power of their consumers’ data to enhance the overall user experience.

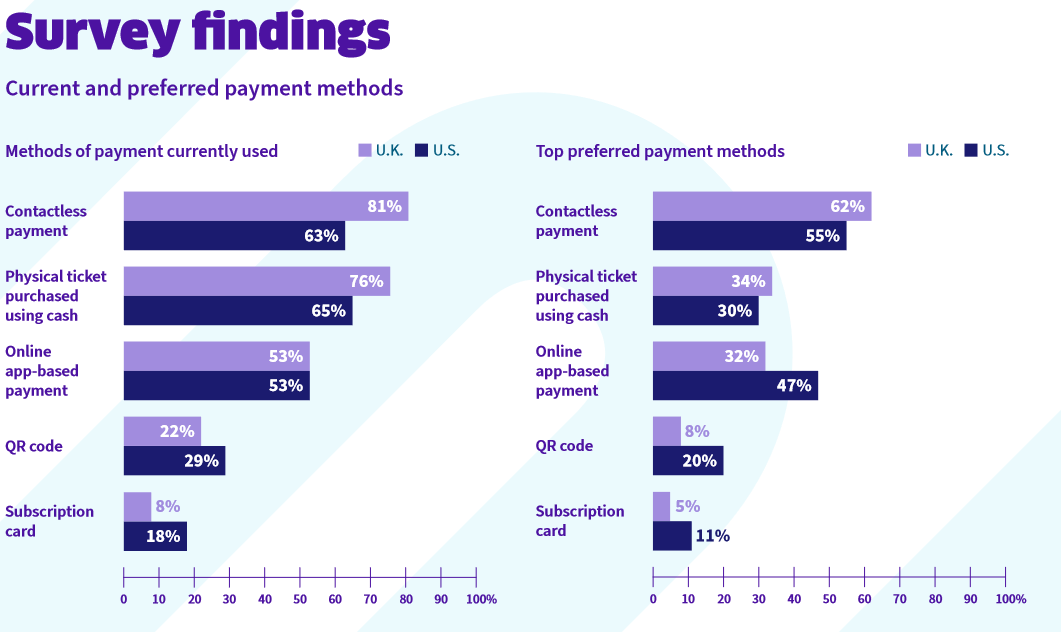

Contactless payment for parking is the leading customer preference, but the U.K. is ahead of the U.S. in terms of adoption.

The U.S. still primarily uses physical ticketing for parking payment, but contactless payment is the preferred method. This presents an opportunity for traditional parking operators to innovate their payment methods to better meet customer needs.

Although 81% of those surveyed in the U.K. already use contactless, physical tickets purchased with cash falls closely behind at 76%. The high use of cash payments in both regions, despite the preference for contactless, could be due to a wider availability of cash payments over contactless. Online and app-based payment for parking is also prevalent in both countries, as parking management companies and aggregator apps gain popularity with their more mobile payment solutions.

The Key Take-Outs

Pre-payment and online/app-based top-ups

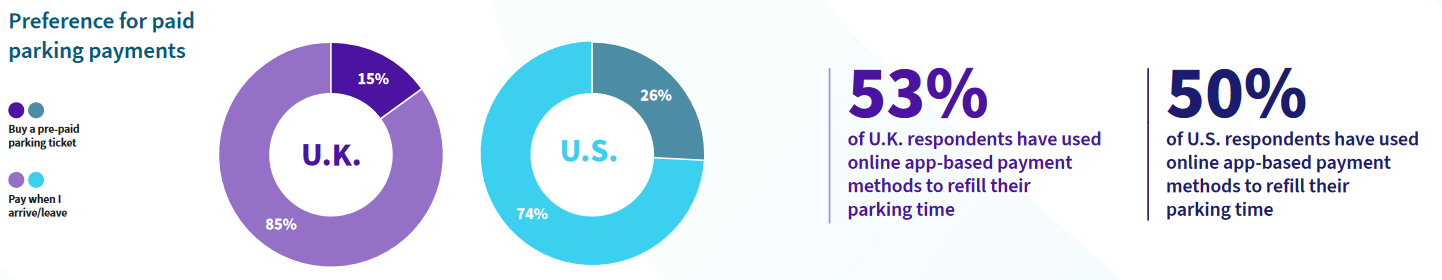

Based on the data, it appears that the majority of individuals do not purchase pre‑paid parking tickets.

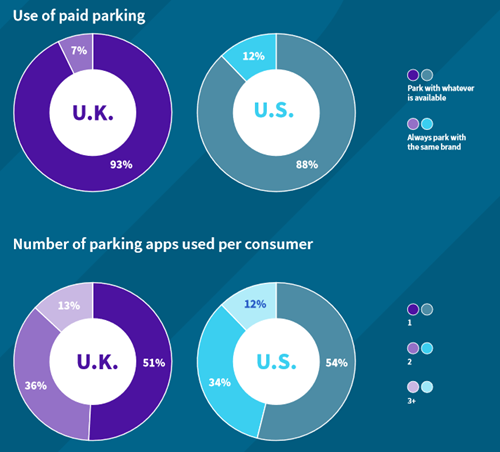

A lack of brand loyalty

| According to our survey, there appears to be a lack of brand loyalty among users when it comes to paid parking. Most respondents in both the U.S. and U.K. reported choosing to park wherever is available rather than with a specific brand – this is highly likely due to the situational nature of parking. |  |

Creating synergies

|

Partnering with complementary services and businesses can be a strategic advantage for paid parking companies seeking to gain a competitive edge. |

Moving Forward

Life’s never moved faster, so providing customers with a seamless payment experience is crucial for any business. Worldpay makes that possible. With our in‑depth vertical expertise and strong network of partners, we are able to build integrations and provide solutions across all areas of the mobility and ground transportation ecosystem.

We also understand that customers’ payment needs are all different, so we offer a wide range of alternative payment methods tailored for markets across the globe.

Our strong eCommerce capabilities enable online and app payments for added convenience, our open-loop/contactless solutions cater to customer preferences, and our tokenization and fraud solutions offer added security. And payment solutions are just the start. We also help our merchants optimize their payment flows, realizing substantial cost savings that can be reinvested into other areas of their business.

About Worldpay

Worldpay has powered businesses of all sizes to make, take and manage payments for over 30 years. Whether online, in store or mobile, you’ll find Worldpay at the heart of great commerce experiences in 146 countries across 225 markets, supporting over 50 unique payment methods across 135 currencies. Additionally, Worldpay offers solutions that help merchants optimise authentication, fight fraud, get real-time business insights and more. In 2022, Worldpay processed $2.2 trillion in total volume. Our customers include some of the biggest brands in the world, such as Amazon, Coca-Cola, Deliveroo, Emirates Airlines, Lenovo, Netflix, PlayStation, Sotheby’s and Zara. To learn more, visit worldpay.com.

Comments

There are no comments yet for this item

Join the discussion